Software capitalization is an accounting practice that treats some software development costs as capital assets rather than expenses. These costs are recorded as assets on the balance sheet and expensed gradually over their life span instead of fully expensed in the period they are incurred.

Software capitalization rules allow businesses to match the cost of developing software with the revenue it generates over time, providing a clearer picture of profitability and financial performance.

Why do we capitalize software costs?

The software capitalization process is not mandatory. But, the reasons below make doing this more convenient and beneficial for your business.

- Aligns costs with benefits: Capitalization matches software costs with the revenues they generate over time. This ensures proper expense allocation and prioritization across projects.

- Improves financial metrics: By reducing immediate costs, capitalization raises operational income, EBITDA, and net profit in the near term, which can boost investor confidence.

- Accurate valuation of assets: Since software is treated as a long-term business asset, it will improve the company’s asset portfolio. This situation will attract potential investors into the business.

- Software R&D capitalization: Software R&D capitalization means treating some of the costs of creating software as a long-term investment (an asset) instead of an immediate expense. Here, we will consider what can be capitalized and the software product’s research and development phase.

Key criteria for software capitalization

- Project intention: The software development project should have a clear purpose, such as internal use within the organization or generating future economic benefits, like revenue or operational efficiency.

- Technical feasibility: A well-defined plan must demonstrate that the software can be successfully developed and put to its intended use.

- Management commitment: The organization must demonstrate an intent and ability to complete and use the software.

- Identifiable costs: Development-related costs must be identified and directly attributable to the project.

- Development phase: Only costs during development (not research or planning) can be capitalized.

- Economic benefit: The software must provide measurable value in the future, like improving efficiency or generating revenue.

- Post-completion use: The software must be intended for long-term use, not a short-term or experimental project.

- Documentation and evidence: Detailed records, including plans, budgets, schedules, and technical documentation, should demonstrate compliance with these criteria and support capitalization decisions.

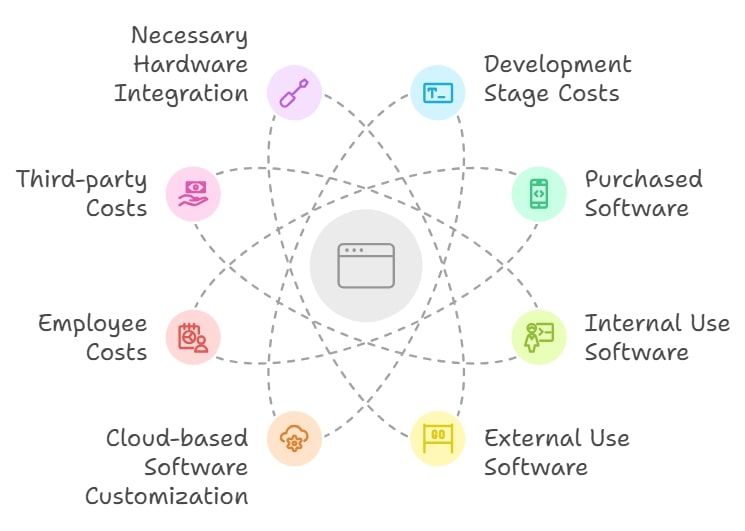

Costs eligible for software capitalization

- Development stage costs: Costs incurred after the research phase. For example, costs for writing code, testing, debugging, and system integration.

- Purchased software: Costs to buy software and make it ready for use, including customization and installation.

- Internal use software: Costs associated with developing software intended for internal company use during the application development stage.

- External use software: Costs incurred after achieving technological feasibility for software developed for sale, lease, or licensing purposes.

- Cloud-based software customization: Costs for configuring or customizing cloud-hosted software solutions to meet specific business needs.

- Employee costs: Employees’ salaries, wages, and benefits are directly involved in the software’s development phase.

- Third-party costs: Payments to vendors, consultants, or contractors for software development tasks and related services.

- Necessary hardware integration: Costs required to integrate software with hardware if such integration is essential for the software’s functionality.

Benefits of software capitalization

- Increased profitability: Capitalizing costs instead of expensing immediately will quickly direct the company to a higher profit.

- Improved asset valuation: Since this adds an intangible asset to the balance sheet, the company can enhance its total asset valuation.

- Better financial reporting: With this capitalization of software, financial reporting can be improved for a company as it spreads across the useful life of the software.

- Aligned costs with revenue: Capitalizing costs aligns investments with future revenue generation. This guarantees that companies are not overcharged for up-front fees, giving a more accurate view of profitability as the software pays off.

- Tax benefits and cash flow improvement: Capitalizing expenses helps spread tax liabilities over several years, avoiding large upfront tax payments and improving cash flow management.

- Enhanced stakeholder confidence: In software capitalization, stakeholders can make long-term investments, and this helps to encourage them to invest more in the business.

- Encouragement for innovation: Encourages companies to invest in innovative projects, knowing that financial impacts can be distributed over time rather than absorbed entirely during development.

Best practices for software capitalization

- Establish clear policies: Establish or develop internal policies that define the parameters and processes for software capitalization within the accepted accounting rules.

- Collaborate across departments: Improve collaboration between finance, engineering, and project management teams to accurately identify and track qualifying expenses.

- Maintain detailed records: Document project phases, cost allocations, and evidence of technological feasibility to support capitalization decisions.

- Regular training: Train relevant teams on the latest accounting standards and software capitalization practices to ensure consistency and compliance.

- Use robust tools: Use accounting and project management software to monitor, track, and allocate expenses efficiently.

- Monitor regulatory changes: Stay updated on changes to accounting regulations and standards that may impact software capitalization practices.

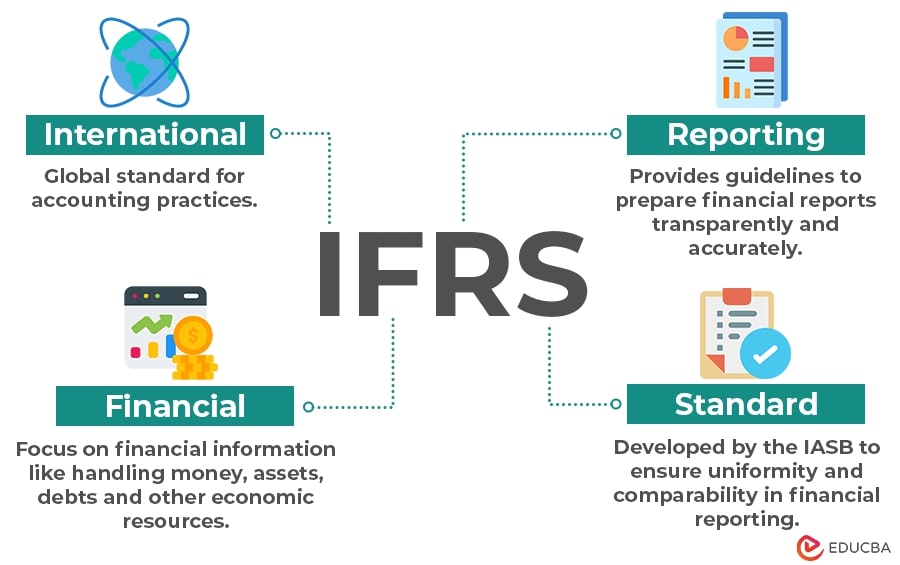

- Use accounting standards: Adopt established frameworks such as IFRS (international financial reporting standards) and U.S. GAAP (generally accepted accounting principles) to ensure accurate reporting and compliance.

Conclusion

Software capitalization effectively manages development costs, aligns expenses with future profits, and enhances financial metrics without incurring immediate losses. However, a strong grasp of accounting principles, internal cost controls, and regulatory requirements is essential for successful implementation.

Businesses can manage the dynamics of software capitalization and improve their performance if they follow best practices, keep meticulous documentation, and promote teamwork within the organization.